Table of Contents:

ToggleIntroduction

Decentralized Finance, or DeFi, has reshaped the traditional financial ecosystem by removing intermediaries and providing permissionless access to financial tools and services. One of the core innovations driving this transformation is DeFi staking, a mechanism that allows users to earn passive income by participating in network security and governance, simply by locking their crypto assets. DeFi staking not only rewards users but also strengthens the blockchain ecosystem, enabling sustainable and scalable growth.

Whether you’re a seasoned crypto investor or a beginner exploring the DeFi world, understanding staking is crucial. In this in-depth guide, we will explore what it is, how it works, the different types, advantages, associated risks, and how platforms like MasterDEX are redefining the staking landscape.

What is DeFi Staking?

It is the process of committing or “locking” crypto assets into a decentralized protocol in order to earn rewards over time. It is primarily associated with Proof-of-Stake (PoS) or PoS-variant blockchains, where staking plays a fundamental role in transaction validation and network security.

When users stake their assets, they essentially contribute to the network’s operations, such as validating transactions or providing liquidity. In return, they receive rewards, often in the same token or sometimes in a secondary token.

Unlike traditional financial systems that offer low-interest savings, DeFi staking enables users to earn yields ranging from 5% to even 100%+ annually, depending on the network, lock-in duration, and market dynamics. Moreover, users don’t need deep technical skills or large capital to start staking—thanks to the evolution of staking pools and user-friendly DeFi apps.

How Does DeFi Staking Work?

Now that we have understood the basics of staking, let’s delve deeper into the DeFi working mechanism.

- Select a Blockchain Network: Choosing the right blockchain is crucial because each one has its own rules, token requirements, and reward structure. Ethereum 2.0, Cardano, Solana, and Polygon are common choices. Consider transaction fees, APY, and network trustworthiness before making a decision.

- Acquire the Native Token: To participate in this process, you need to buy the blockchain’s native currency. This means buying ETH for Ethereum, ADA for Cardano, etc. These tokens are used for staking and also for paying transaction fees on the network.

- Set Up a DeFi Wallet: You’ll need a non-custodial wallet that gives you control of your private keys. Popular wallets like MetaMask, Trust Wallet, or Ledger integrate easily with most DeFi apps. Ensure the wallet supports staking for the blockchain you selected.

- Transfer Tokens to Wallet: After purchasing tokens from an exchange, transfer them to your wallet. Always double-check the wallet address to prevent irreversible losses.

- Choose a Suitable Method

- Direct Staking: You become a validator by running a node and staking a large sum of tokens. Best for advanced users.

- Delegated Staking: You delegate your tokens to a validator who does the work for you and shares the rewards.

- Staking Pools: These pools collect tokens from many users to reach the minimum stake amount and distribute rewards proportionally.

You can choose what strategy suits you the best.

- Direct Staking: You become a validator by running a node and staking a large sum of tokens. Best for advanced users.

- Start Staking: Follow instructions on the platform to lock your tokens. You’ll select the amount, choose a validator or pool, and confirm the transaction. Once staked, your tokens are locked for the duration of your chosen term.

- Track Rewards and Unstake: Use dashboards offered by the staking platform to monitor your earnings. At the end of your lock-up period, you can unstake your tokens and claim rewards.

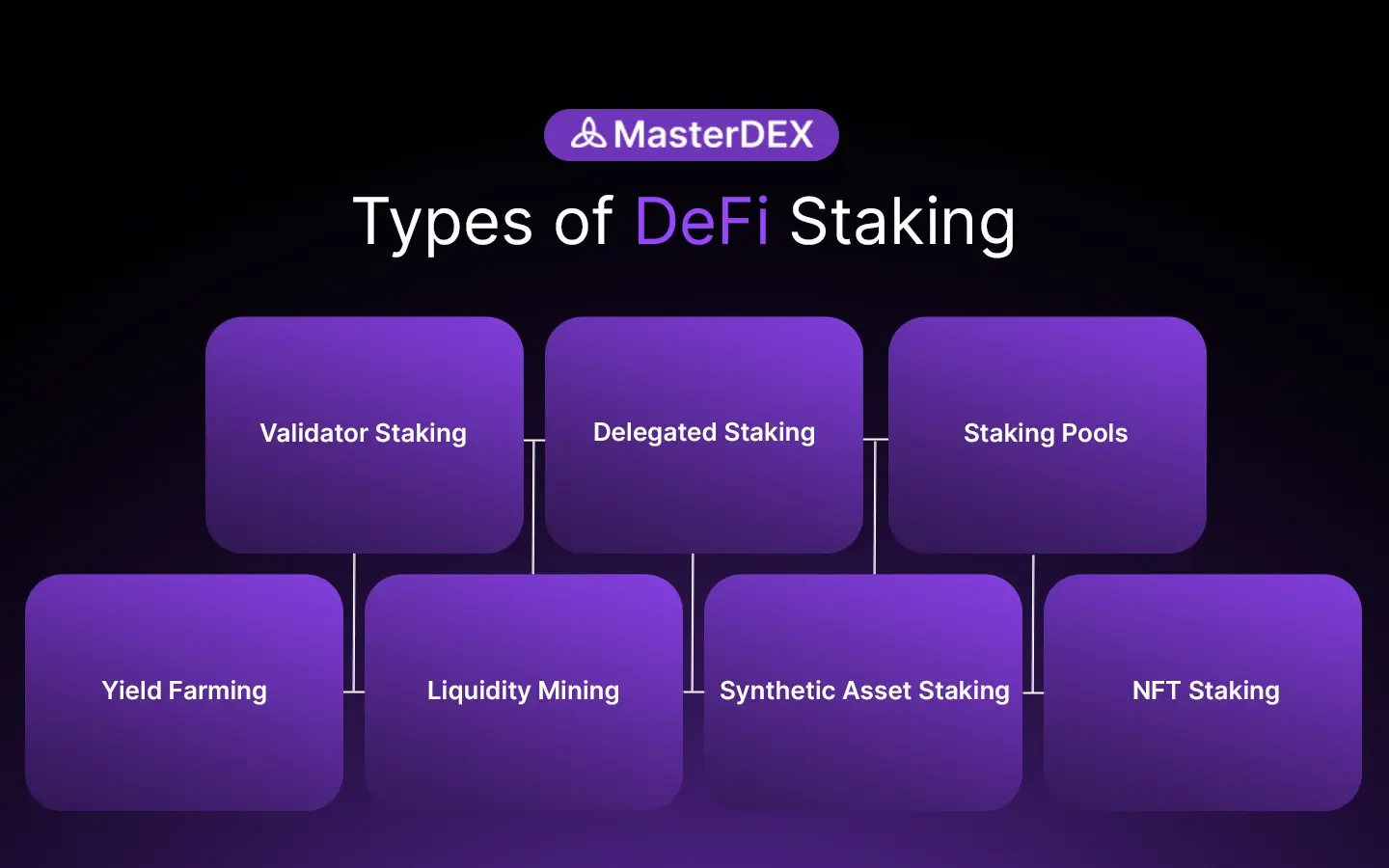

Types of DeFi Staking

DeFi staking comes in many forms, each offering unique mechanisms, benefits, and levels of complexity. Understanding these types can help users choose the best strategy based on their risk appetite, technical expertise, and investment goals.

1. Validator Staking

Validator staking is the most fundamental form of staking, where a user becomes a validator by locking up a significant amount of tokens. Validators are essential to the blockchain—they propose and verify blocks, confirm transactions, and ensure the integrity of the network. Becoming a validator typically requires technical expertise, high uptime, and substantial capital (e.g., 32 ETH on Ethereum 2.0). Validators are rewarded for their honesty and activity, while malicious behavior (like double-signing) can lead to slashing—where a portion or all of their staked tokens are forfeited.

2. Delegated Staking

This model allows users who don’t have enough tokens or technical knowledge to participate by delegating their tokens to a trusted validator. In return, they earn a share of the validator’s rewards. Delegated staking enhances inclusivity and decentralization. It’s especially popular in networks like Cosmos (ATOM), Tezos (XTZ), and Polkadot (DOT). While delegators don’t need to run nodes, they must choose reliable validators, as they can still be penalized (partially) for validator misbehavior.

3. Staking Pools

Staking pools are community-driven pools where multiple users combine their assets to collectively stake and earn rewards. This is a great option for users with smaller token holdings. The pool distributes rewards based on each participant’s contribution. Pools usually charge a small fee for operating the infrastructure. These pools lower the barrier to entry and enable consistent, lower-risk participation without requiring users to manage nodes or monitor uptime.

4. Yield Farming

Yield farming is a more complex but higher-yield variation of staking. Instead of helping secure a blockchain, users move their assets across multiple DeFi protocols to maximize returns. Yield farmers provide liquidity, lend assets, or stake in high-yield pools, often receiving both interest and native governance tokens in return. The key attraction is compounding rewards through strategic positioning. However, it involves constant monitoring, exposure to impermanent loss, and high smart contract risk.

5. Liquidity Mining

Liquidity mining involves providing tokens to decentralized exchanges (DEXs) like Uniswap, SushiSwap, or PancakeSwap. Users deposit equal values of token pairs (e.g., ETH/USDC) into liquidity pools. In return, they receive LP (Liquidity Provider) tokens that represent their share. They earn a portion of the transaction fees and may receive extra incentives in the form of governance or native DEX tokens. Liquidity mining helps build liquidity in DEX markets while offering passive income opportunities.

6. Synthetic Asset Staking

This involves staking assets to mint synthetic tokens that represent real-world assets. Platforms like Synthetix let users stake SNX to mint sUSD (synthetic USD) and other assets representing fiat currencies, stocks, or commodities. The staked tokens act as collateral. This allows users to gain exposure to traditional financial markets while still operating within DeFi, though it introduces additional risks related to over-collateralization, market oracles, and protocol solvency.

7. NFT Staking

NFT staking is a relatively new form of staking where users lock their non-fungible tokens in a protocol to earn rewards. These rewards could be in the form of platform tokens or new NFTs. It’s especially popular in GameFi (e.g., Axie Infinity, Gala Games) and digital collectibles ecosystems. NFT staking adds utility to NFTs by turning them into yield-generating assets, fostering deeper engagement with gaming or community ecosystems.

Key Benefits of DeFi Staking

Before diving in, it’s essential to understand why DeFi staking has gained so much popularity. Here are the key benefits that make it attractive to both new and seasoned crypto investors.

Passive Income Generation

Staking provides a way to earn crypto without actively trading. Rewards are distributed periodically, providing a predictable income stream. Long-term investors benefit from compounding returns by restaking earned rewards, helping build wealth passively over time.

Network Security

By staking, users contribute to network decentralization and security. Validators are incentivized to behave correctly, as malicious actions can lead to loss of staked funds (slashing). The more assets are staked, the harder it becomes for malicious actors to attack the network.

Governance Participation

Many staking models come with governance rights. Token holders can vote on important protocol changes like fee structures, upgrades, and project direction. Active community participation fosters decentralization and transparency within DeFi protocols.

Portfolio Diversification

Staking allows exposure to various assets and platforms. Users can stake stablecoins, governance tokens, or volatile assets, reducing risk while maximizing returns. Additionally, users can diversify across multiple staking strategies like pools, farming, and synthetic assets.

Flexibility & Accessibility

Staking is globally accessible. Users can stake from anywhere using just a wallet and the internet. Many platforms offer flexible lock-up periods or even instant unstaking, making it suitable for both short-term and long-term strategies.

Higher Yields Compared to Traditional Finance

Traditional banks offer interest rates under 1%. In contrast, DeFi staking can yield 5%–20%+ annually, depending on network dynamics and token demand. Some high-risk DeFi platforms even advertise yields above 100% during bull markets, though caution is advised.

Reduced Need for Active Trading

Staking removes the emotional pressure and risk of day trading. Investors can generate predictable returns without trying to time the market, making it ideal for hands-off, disciplined investment strategies.

Major Risks to Consider

While DeFi staking offers promising returns, it’s not without its risks. Being aware of these potential pitfalls is crucial for making informed and secure investment decisions.

Market Volatility

Crypto prices are highly volatile. Even if you earn rewards, the value of your staked assets may fall, reducing the overall profit. This is especially risky during bear markets or sudden market downturns.

Smart Contract Vulnerabilities

Staking involves smart contracts. If they’re not properly audited or secured, hackers can exploit them and drain funds. Always stake on well-reviewed platforms. Even small bugs can lead to massive losses.

Impermanent Loss

In liquidity mining, token price fluctuations can lead to a situation where the value of your staked assets is lower than if you had just held them. This is especially true when volatile tokens are paired with stablecoins.

Lock-in Periods & Liquidity Risk

Many staking protocols enforce a lock-up period, during which your tokens cannot be accessed. Emergencies or market drops during this period can be problematic. Users may also miss out on better opportunities elsewhere.

Regulatory Uncertainty

Governments around the world are still shaping crypto regulations. Staking models might be impacted by changing laws or restrictions in the future. Unregulated platforms may also pose legal risks to users.

Validator Risk

Delegating your tokens to a validator involves trust. If the validator misbehaves or is offline, your rewards may be reduced, or you might face slashing. Researching validator performance is critical before delegating

Concluding Lines

DeFi staking is revolutionizing how crypto investors grow their wealth—offering a secure, passive income model without needing deep technical knowledge. From validator staking to yield farming, the possibilities are diverse. But as with any financial instrument, it’s essential to understand the underlying risks and choose trusted platforms.

MasterDEX now empowers Reward Hub users with the ability to stake their claimable $MDEX tokens and earn passive income with ease. Offering flexible durations—from 30 days to 12 months—and attractive APYs of up to 10%, the platform is designed to help users grow their holdings in alignment with their investment goals. Whether you’re aiming for short-term gains or long-term value, MasterDEX staking provides a seamless and sustainable way to make your $MDEX work for you.