Table of Contents:

ToggleIntroduction: Why Understanding Bitcoin’s Price Matters?

Bitcoin is often described as digital gold, a decentralized currency, or a store of value, but at its core, it is an asset whose price is constantly in motion. Since its inception in 2009, Bitcoin has captivated global markets, experiencing dramatic price surges followed by steep corrections. Its volatile nature has attracted investors, traders, and institutions, all looking to capitalize on its unique behavior.

But what exactly causes these price fluctuations?

Unlike fiat currencies, Bitcoin isn’t backed by a central bank or government. There is no singular authority deciding its price. Instead, Bitcoin’s value is shaped by a blend of technological fundamentals, global events, market sentiment, and economics. Understanding how Bitcoin’s price is determined is crucial not just for investors, but for anyone looking to grasp the broader mechanics of the cryptocurrency market.

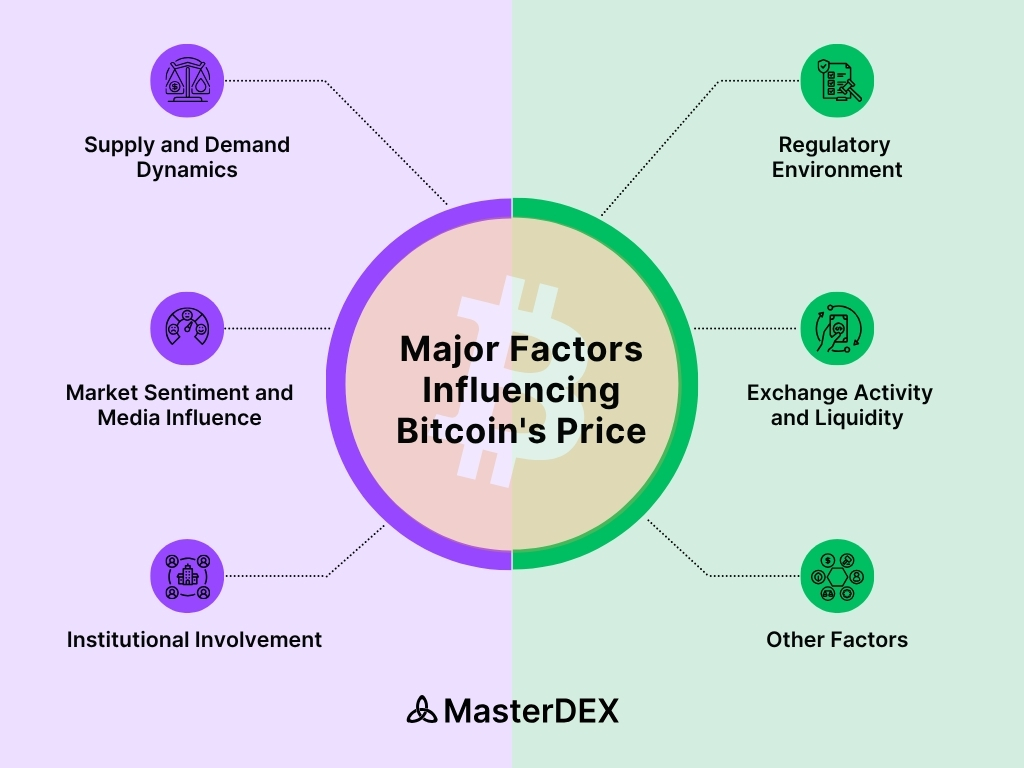

Let’s explore the major factors that influence Bitcoin’s price.

Major Factors Influencing Bitcoin’s Price

1. Supply and Demand Dynamics

Bitcoin operates on a fixed supply model: only 21 million coins will ever exist. This programmed scarcity is embedded in Bitcoin’s code and is one of the key reasons it is often compared to precious metals like gold.

Every four years, the network undergoes a “halving” event, which cuts the block reward for miners in half. This reduces the rate at which new bitcoins enter circulation. Historically, halving events have been closely followed by bull markets, due to the decreased supply and continued or increased demand.

But scarcity alone doesn’t drive price; demand must meet or exceed it. During bullish periods, demand spikes due to growing public interest, institutional adoption, or economic instability. As buyers outnumber sellers, prices climb. Conversely, during bearish phases, when demand drops or investors offload holdings, prices fall regardless of the fixed supply.

2. Market Sentiment and Media Influence

Emotions play a powerful role in price movements. Bitcoin’s price is often a reflection of how people feel about it at any given moment, i.e., optimistic or fearful. The media significantly amplifies this effect. Positive news such as a major country adopting Bitcoin, a company adding it to its balance sheet, or the launch of a Bitcoin ETF tends to spark massive buying waves. On the other hand, negative news, such as exchange hacks, rug pulls, environmental concerns over mining, or fears of regulation, can rapidly deflate prices.

Social media platforms like Twitter, Reddit, and Telegram also serve as breeding grounds for bullish or bearish sentiment. Influential voices, whether it’s a crypto thought leader or a celebrity like Elon Musk, can shift the mood of the market with a single post.

Market psychology leads to two common investor behaviors:

- FOMO (Fear of Missing Out): Drives impulsive buying in bullish phases.

- FUD (Fear, Uncertainty, Doubt): Causes panic selling during negative events.

3. Institutional Involvement

The crypto landscape changed dramatically when institutional investors began to enter the space. Asset managers, hedge funds, and public companies now play a significant role in Bitcoin’s price formation.

When Tesla announced in early 2021 that it had purchased $1.5 billion worth of Bitcoin, the market responded with a surge in price. Likewise, companies like MicroStrategy continued to accumulate large quantities of Bitcoin, fueling bullish sentiment and demonstrating long-term confidence.

Beyond direct investments, institutional support includes:

- Futures contracts and ETFs that give traditional investors exposure to Bitcoin without holding it directly.

- Custodial services tailored for institutional clients, which increase trust and ease of access.

- Crypto-focused hedge funds and asset managers are allocating capital to Bitcoin as a strategic asset.

As institutions buy large volumes, they reduce available supply on exchanges, driving prices up. Conversely, large-scale sell-offs can trigger sharp corrections.

4. Regulatory Environment

Bitcoin exists outside traditional financial systems, but it doesn’t operate in a legal vacuum. Government regulations, tax laws, and policy statements have profound effects on Bitcoin’s price.

Regulatory clarity often encourages adoption. When countries introduce crypto-friendly policies or clear legal frameworks, investors feel more secure participating in the market. For example, nations that legalize crypto exchanges or approve Bitcoin ETFs tend to boost market sentiment.

On the flip side, negative regulatory news has historically caused sharp declines. For instance:

- China’s repeated bans on crypto-related activities have triggered multiple market sell-offs.

- The U.S. SEC’s scrutiny of crypto platforms and tokens creates uncertainty.

- Taxation announcements in major economies often result in temporary price drops as traders adjust portfolios.

Regulations can also influence how banks, investment firms, and payment processors interact with Bitcoin—either facilitating its growth or limiting its usage.

5. Exchange Activity and Liquidity

Bitcoin’s price is discovered primarily on crypto exchanges, where buyers and sellers meet to trade. However, Bitcoin doesn’t have a universal price. Different exchanges might display slightly different prices depending on factors like:

- Liquidity: The amount of available buy/sell orders at different price levels.

- Volume: Heavily traded exchanges often have more stable and consistent prices.

- Geographic Influence: Certain exchanges dominate specific regions and reflect local demand or restrictions.

For instance, during times of high demand in South Korea, a phenomenon known as the “Kimchi Premium” has occurred, where Bitcoin was traded at a higher price than in global markets.

The mechanisms at play include:

- Order books: Where prices are determined by matching buy/sell offers.

- Arbitrage: Traders buying low on one exchange and selling high on another, which helps equalize prices across platforms.

- Slippage: On low-liquidity exchanges, large trades can move the price significantly, resulting in greater volatility.

Popular decentralized exchanges such as MasterDEX and over-the-counter (OTC) desks also play a role, but centralized exchanges still dominate the price discovery process.

6. Other Underlying Influences

While Bitcoin’s price is shaped by well-known market forces like supply, demand, and regulation, several deeper layers of influence operate beneath the surface. These may not always drive immediate price swings but play a crucial role in shaping Bitcoin’s long-term value and volatility.

Network Effects and Adoption

Bitcoin becomes more valuable as more people use it. This is known as the network effect. Each new user, merchant, investor, or node added to the Bitcoin ecosystem increases its overall utility. This growing usage reinforces trust in the network and drives up demand, contributing to long-term price appreciation.

For example, increasing adoption in emerging markets, rising institutional custody services, or integration into fintech platforms expands Bitcoin’s user base and solidifies its position as a financial asset.

Real-World Utility and Technological Improvements

Bitcoin’s value is also derived from how effectively it functions as a currency or a store of value. Innovations like the Lightning Network have improved Bitcoin’s scalability and usability for fast, low-cost transactions. As these technologies become more robust and widely used, Bitcoin’s utility grows, drawing in users and investors who believe in its functional potential.

This utility-driven demand adds a foundational layer to its valuation, especially during periods of speculative quiet.

Cost of Production (Mining Economics)

Bitcoin mining is a capital-intensive process. It requires advanced hardware and significant electricity usage. As mining difficulty increases, so does the cost of producing new bitcoins. This acts as a kind of “floor” for Bitcoin’s price. If the market price drops too low, miners may find it unprofitable to continue operating, reducing supply pressure.

This supply adjustment mechanism isn’t immediate but contributes to longer-term price stabilization, particularly after major network events like halvings.

Whale Activity and Large Holders

A relatively small number of wallets control a substantial portion of all Bitcoin in circulation. These “whales” have the ability to move markets. Large-scale buying or selling by a single entity can trigger cascading effects on price through panic or momentum-based trading.

Moreover, whales sometimes act in coordinated or anticipatory ways, accumulating when sentiment is low and selling during periods of euphoria. Their behavior often precedes major market reversals and is closely tracked by analysts.

Concluding Lines

Bitcoin’s price is the outcome of a complex interplay between market mechanics, human psychology, macroeconomics, institutional interest, and technological fundamentals. Its volatility may appear chaotic, but it often reflects rational responses to news, supply and demand, liquidity, and policy changes.

For investors and observers alike, understanding these core drivers is not just academic, it’s strategic. It empowers smarter decisions, sharper risk assessments, and deeper insight into the broader financial landscape that Bitcoin now inhabits.

As Bitcoin continues to mature and integrate into global markets, its price will increasingly mirror both the hopes and anxieties of a rapidly changing world.