This article explores the foundation of decentralized finance (DeFi) and explains how DeFi smart contracts are driving innovation across the financial ecosystem.

Table of Contents:

ToggleWhat and Why of Decentralized Exchange?

Decentralized Finance (DeFi) is an innovative financial system built on blockchain technology, aiming to eliminate the need for traditional intermediaries like banks and brokers. At the core of this ecosystem are smart contracts self-executing agreements that automatically facilitate transactions based on predefined rules.

Unlike centralized financial systems that often require users to share personal and sensitive data, DeFi enables permissionless access through digital wallets, offering greater privacy, security, and transparency. Users can interact with DeFi protocols directly, often without revealing their identity, while enjoying real-time transactions with minimal fees.

By offering core benefits such as inclusivity, autonomy, lower transaction costs, and flexible interest rates, DeFi is revolutionizing access to financial services. This is especially impactful for underbanked populations around the world, enabling financial participation without relying on traditional banking infrastructure.

Understanding the Basics of Smart Contacts

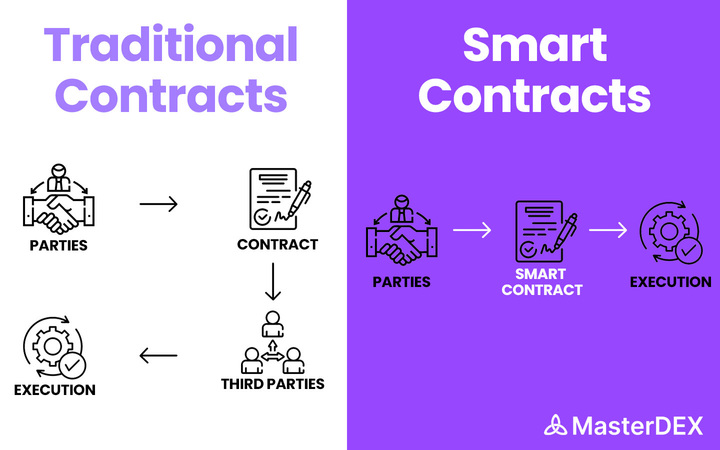

Smart contracts are the engine behind DeFi. These are automated digital agreements stored on the blockchain that execute specific actions when predetermined conditions are met without the need for intermediaries.

A simple analogy would be a vending machine: insert the correct amount, and the machine dispenses your selected item. If the conditions are not met, the transaction does not go through. Similarly, smart contracts automatically enforce terms once all requirements are fulfilled, reducing room for human error and manipulation.

Unlike traditional legal contracts, DeFi smart contracts operate transparently on the blockchain and are visible to all participants, promoting accountability while reducing paperwork and administrative overhead.

The Role of Smart Contracts in the DeFi Ecosystem

Now that we have understood what DeFi and what smart contracts are, let us discuss their role in the DeFi ecosystem.

1. Automating Transactions

DeFi smart contracts automate the execution of transactions such as lending, borrowing, trading, and staking. This removes the need for intermediaries, significantly lowering costs and increasing speed. Automation also ensures that transactions occur exactly as programmed, minimizing risk and enhancing reliability.

2. Enabling Financial Inclusion

By eliminating traditional barriers like credit checks or geographical restrictions, smart contracts allow users worldwide to access financial services. Whether someone is in a developed city or a remote village, all that’s needed is a crypto wallet and internet connection to participate in the DeFi economy.

3. Building a Decentralized Infrastructure

Smart contracts are deployed on decentralized blockchains, ensuring that no single entity has overarching control. This decentralization safeguards the ecosystem against censorship, manipulation, or centralized failure, making it more resilient and democratic.

4. Supporting Interoperability

Many DeFi smart contracts are designed to interact with multiple platforms and protocols. This allows decentralized applications (dApps) to communicate seamlessly, supporting complex financial use cases like cross-chain swaps, yield farming, and synthetic asset trading.

5. Ensuring Transparency and Security

All actions taken by a smart contract are recorded on the blockchain and are publicly auditable. This level of transparency builds trust among users, while the cryptographic security of blockchain networks protects data from tampering and fraud.

The Future of DeFi Smart Contracts

MasterDEX is among the projects advancing the DeFi landscape by offering innovative features powered by smart contracts. From secure token swaps to automated liquidity pools, platforms like MasterDEX are demonstrating how DeFi can rival and even surpass traditional finance in terms of flexibility and control.

As reported by Grand View Research, the global DeFi market was valued at USD 16.3 billion in 2023 and is projected to grow to USD 231.2 billion by 2030. This massive growth underscores the expanding role of DeFi and the central importance of smart contracts in that evolution.

Final Thoughts

DeFi smart contracts are the backbone of a decentralized financial system powering everything from trading and lending to insurance and crowdfunding. They eliminate the need for third parties, enhance trust through transparency, and drive financial inclusion on a global scale.

As DeFi continues to evolve, smart contracts will remain at the heart of this transformation empowering users with greater control over their assets and shaping the next generation of global finance.