This article explains how a DEX limit order book works, its benefits, and key strategies such as price setting, market depth analysis, stop-loss orders, and trading automation to optimize your trading experience. Let’s start with understanding what is a limit order in crypto trading.

Table of Contents:

ToggleUnderstanding Limit Orders in Crypto Trading

In crypto trading, a limit order is a type of trade that allows users to buy or sell an asset at a specific price or better. Unlike market orders, which execute instantly at the current price, limit orders give traders precise control over the execution price. This ensures they don’t have to accept unfavorable market prices due to volatility.

A limit order remains open until the market reaches the set price. For example, if a trader wants to buy Bitcoin but prefers a lower price than the current market rate, they can place a limit order at $50,000. If Bitcoin’s price drops to this level, the order executes automatically. Otherwise, it remains pending until the condition is met.

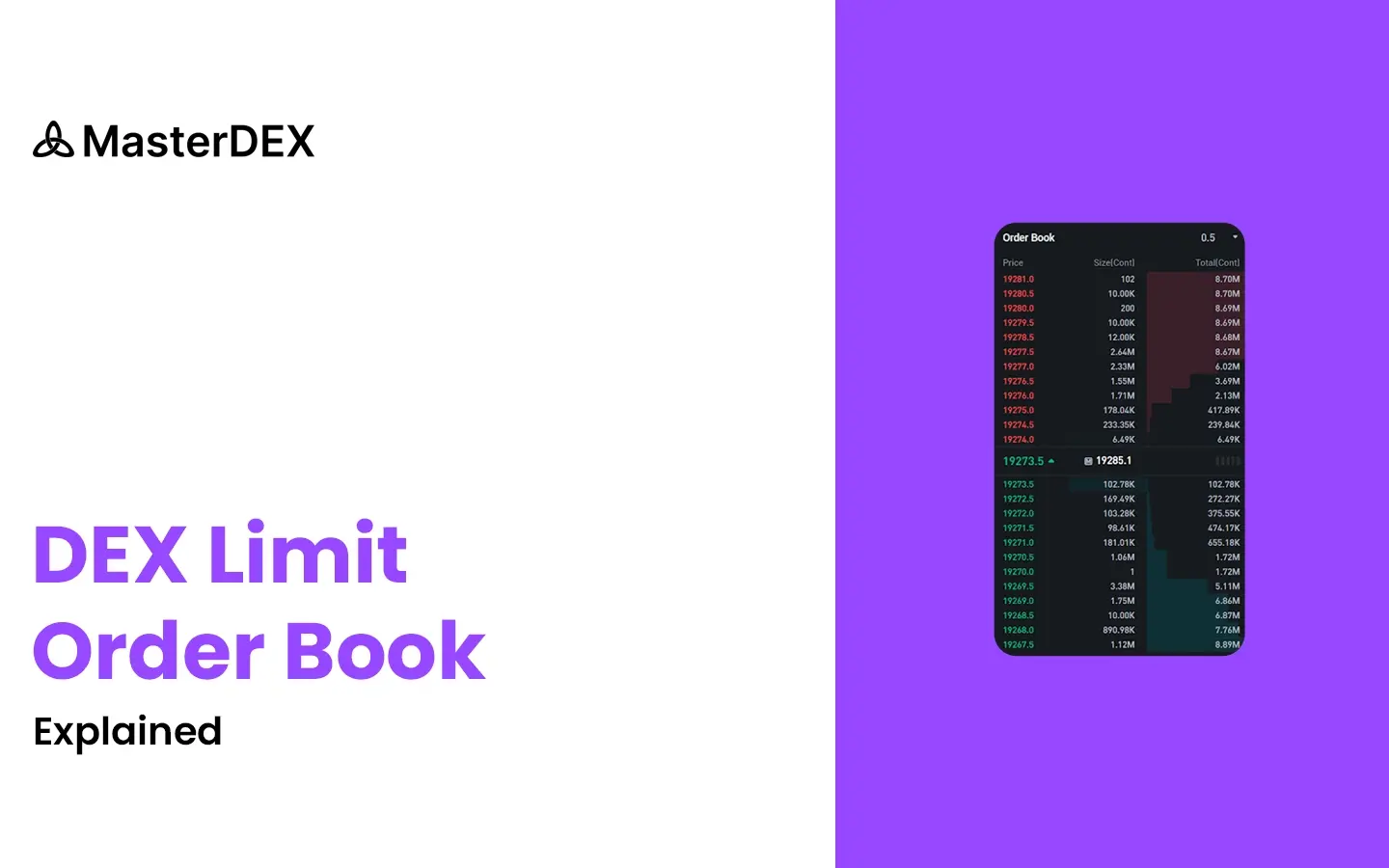

How Does a DEX Limit Order Book Work?

Decentralized Exchanges (DEXs) have redefined trading by eliminating intermediaries and allowing users to trade assets directly. One of the key mechanisms enabling this is the limit order book, which organizes buy and sell orders in a decentralized manner.

In a DEX, the limit order book functions by recording all open buy and sell orders on-chain. Traders specify their desired price and asset amount, and these orders are stored in a public ledger. When a matching order is found, a smart contract executes the trade automatically, ensuring trustless and transparent transactions.

Unlike centralized exchanges (CEXs), which manage order books through a central authority, DEXs rely on blockchain technology. This ensures that trades are censorship-resistant, funds remain in users’ control, and execution is governed by smart contracts rather than a third party.

DEX development plays a crucial role in ensuring efficient order matching, liquidity aggregation, and secure trade execution. Developers design these systems to optimize performance while maintaining decentralization. By integrating liquidity from multiple sources, DEXs can provide better trading conditions and reduce price slippage.

Benefits of Using Limit Orders on a DEX

- Control Over Execution Price – Traders set their desired buy/sell price, ensuring trades only execute under favorable conditions.

- Reduced Slippage – Since limit orders execute at a specified price or better, they prevent unexpected price changes during execution.

- Market Timing Advantage – Traders can buy assets at lower prices and sell at higher prices, maximizing profits from price movements.

- No Need for Constant Monitoring – Orders execute automatically when conditions are met, allowing traders to focus on other activities without watching the market 24/7.

Key Strategies for Using a Limit Order Book in a DEX

Using a limit order book effectively in a Decentralized Exchange (DEX) requires a combination of smart trading strategies and risk management. Here are some key techniques to help traders optimize their trades, reduce risk, and maximize efficiency.

Set Realistic Prices

When placing limit orders, ensure that your price aligns with current market conditions. Setting a price too high (for buy orders) or too low (for sell orders) may result in your order remaining unfilled for an extended period. To maximize execution probability, analyze recent price trends, market momentum, and support and resistance levels. By setting realistic price points, you improve the chances of your trade being executed while maintaining control over the transaction.

Monitor Market Depth

Market depth refers to the number of buy and sell orders at different price levels in an order book. By regularly analyzing the order book, traders can assess liquidity, understand supply and demand dynamics, and make better-informed trading decisions. A deep market with a large number of orders generally leads to smoother trade execution and reduced price volatility, whereas a shallow market may result in slippage or order delays. Keeping an eye on market depth can help traders time their trades effectively and adjust their limit orders accordingly.

Analyze Order Flow

Order flow represents the movement of buy and sell orders in the market. A sudden surge in buy orders can indicate increased demand and potential price growth, while a rise in sell orders may suggest a possible price drop. By closely monitoring changes in order volume and execution patterns, traders can anticipate market trends and adjust their strategies accordingly. Order flow analysis can also help traders identify periods of high volatility, allowing them to avoid unfavorable trading conditions or take advantage of short-term price movements.

Take Advantage of Limit Orders

Limit orders allow traders to buy assets at a lower price and sell them at a higher price, giving them greater control over their trades. Placing buy orders below the current market price and sell orders above the market price allows traders to capitalize on price swings and take advantage of market fluctuations. This strategy is especially useful for avoiding impulse trades and ensuring that assets are acquired or sold only when favorable price conditions are met.

Use Stop-Loss Orders

Stop-loss orders are essential for managing risk in volatile markets. A stop-loss order is a preset instruction to automatically sell an asset when its price drops below a specified threshold. This helps traders prevent excessive losses by exiting a trade before the price declines further. For example, if you set a stop-loss at 5% below your purchase price, your asset will automatically be sold if the market dips to that level, helping you limit downside risk and protect your portfolio from severe losses.

Avoid Front-Running

Front-running occurs when traders exploit pending limit orders by placing their own orders ahead of them, capitalizing on the expected price movement. This is especially common in decentralized exchanges, where transactions are publicly visible on the blockchain before execution. To mitigate front-running risks, traders can split large orders into smaller transactions, use private transaction pools, or set limit orders at non-obvious price points. Implementing these strategies can help reduce exposure to front-running tactics and improve trade execution efficiency.

Leverage Trading Bots

Automated trading bots can be a valuable tool for executing limit orders based on predefined strategies. Bots help traders automate their trades, remove emotional decision-making, and ensure timely execution. They can monitor the market 24/7, detect optimal trade conditions, and execute limit orders instantly when price targets are met. Using bots for limit order trading is especially beneficial in volatile markets where prices move rapidly, as they eliminate the need for manual monitoring and execution.

Diversify Orders

Rather than placing a single large order, consider breaking it into multiple smaller orders at different price levels. This strategy helps minimize market impact, increase the likelihood of execution, and provide better price averaging. By diversifying limit orders, traders can improve their entry and exit points, avoid slippage, and achieve a more balanced trading strategy. This approach works particularly well in illiquid markets, where large orders can cause sudden price swings.

The Bottom Lines

Mastering these strategies can help traders make the most of DEX limit order books by reducing risk, improving trade execution, and increasing profitability. Whether you are a beginner or an experienced trader, combining market analysis, risk management, and automation can give you a strong edge in the decentralized trading landscape.